Dr. Elizabeth Cobbett recently presented research on the spread of global finance into Sub-Saharan African markets. She reflects on how new technology is being used to move Africa away from cash-based economies.

A workshop was organized at Warwick University on November 15th to identify and analyse the different ways in which global finance continues to respond to the 2008 Global Financial Crisis. My presentation was on resilience through the spread of global finance into Sub-Saharan African markets.

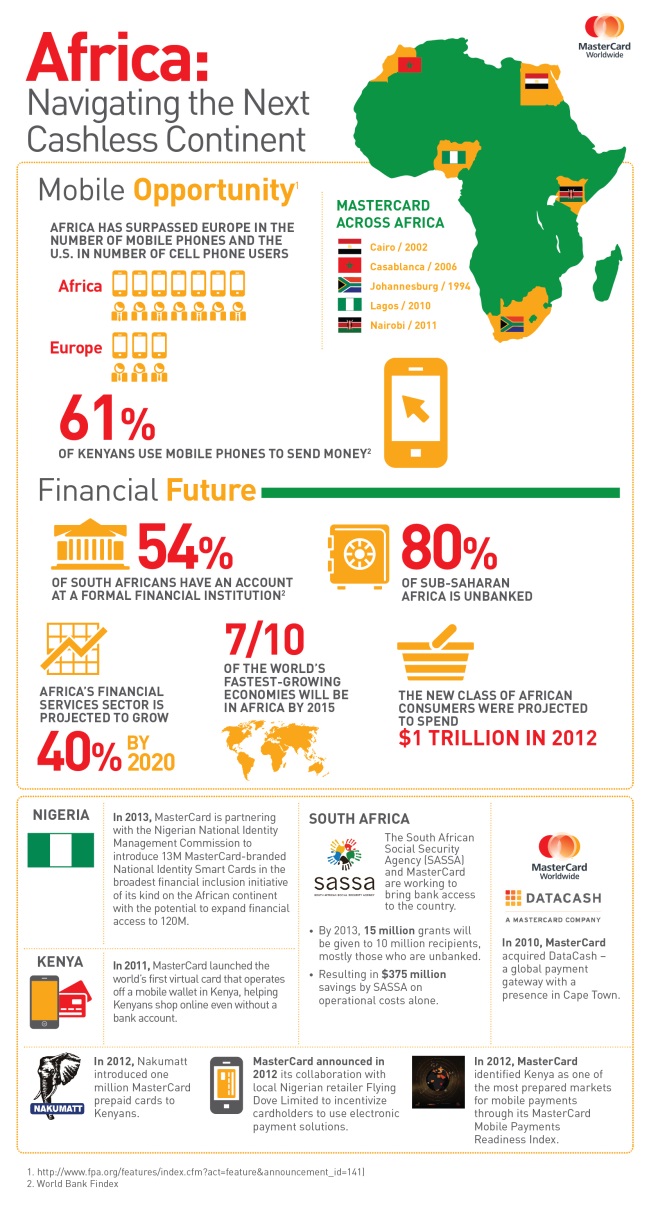

While western economies retrenched following the financial crisis of 2008, global financial firms see opportunity for expansion through the creation of new markets in developing and emerging economies. Resilience to crises, recession, high unemployment, and general depression in industrialised economies is being found in ‘new’ markets, notably in Africa. Africa is the world’s fastest-growing continent with an expected average growth of 6 per cent. It also has the lowest rate of banked populations. Bringing in 2.5 billion unbanked adults worldwide into formal financial structures, such as through MasterCard’s e-payments debit cards is a way for global finance to keep growing.

We all know that emerging powers underpin global growth and trade. The biggest consumer markets will be in these and developing economies in the Global South.

Africa is technologically leapfrogging financial infrastructures in industrialized economies.

While African markets are historically dominated by banks, global financial companies are using new technologies, such as information technology (IT) and biometrics, to operate on the continent. Transformation in banking and the delivery of financial services through digitalized biometric technology is a capability that enables global finance to reach sectors of the populations previously excluded from the formal financial centre.

This is a significant shift as societies move away from cash-based economies to greater use of electronic payments, a trend that is emphasised in the emerging markets of Africa. Banking is becoming more akin to process than to ‘place’ as face-to-face encounters at the teller in local branches are replaced by electronic money – e-money. Nowhere is this more apparent than in Africa.

The main allure of Africa’s banking market is that it is vast and largely untapped. The potential for financial expansion is huge and can be synchronised with the move by African firms and governments to apply the latest technological innovations within domestic economies. Africa is effectively technologically leapfrogging financial infrastructures in industrialized economies.

The main allure of Africa’s banking market is that it is vast and largely untapped. The potential for financial expansion is huge and can be synchronised with the move by African firms and governments to apply the latest technological innovations within domestic economies. Africa is effectively technologically leapfrogging financial infrastructures in industrialized economies.

Elizabeth Cobbett is lecturer in International Political Economy at UEA. Her research focuses on the ways in which global finance seeks profitable opportunities within localised structures. This amplifies the significance of social factors often ignored by mainstream approaches. Present research focuses on the growth of key African financial hubs – South Africa, Nigeria and Kenya.